Content

The amount you could potentially subtract depends on the new property’s prices, after you first started by using the property, the length of time it requires to recuperate their cost, and and that depreciation approach you utilize. An excellent depreciation deduction are one deduction to possess depreciation or amortization or all other deductible deduction you to definitely snacks a money costs as the a allowable debts. Transportation earnings is actually money on the usage of a boat otherwise aircraft or for the newest overall performance out of features personally linked to the fresh access to any vessel or routes.

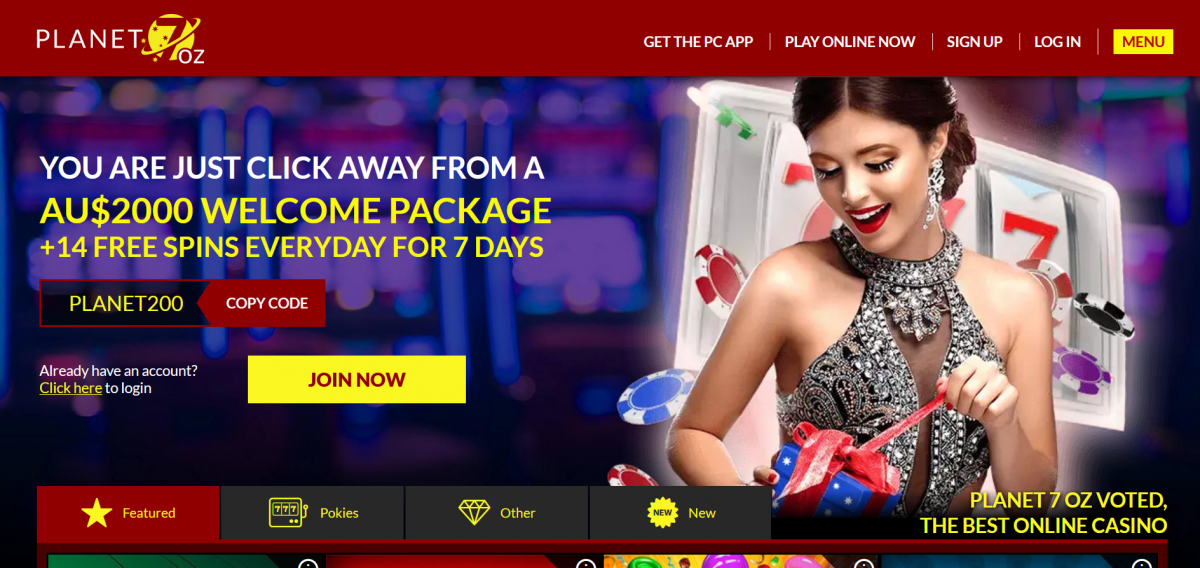

Pro does their taxes: casino promotions deposit 5 get 30

Citizenship and you may casino promotions deposit 5 get 30 Immigration Characteristics (USCIS) (otherwise the predecessor company) have awarded you a form I-551, Permanent Resident Card, labeled as a green card. You still features resident status lower than that it sample until the new status is removed away from you or is administratively or judicially computed to possess started quit. E-wallets including Neteller and you can Skrill tend to ask you for to make an initial greatest-right up of the account and will also charge a fee when you withdraw funds from the machine. In the new meantime, you’ll be swinging currency around between online casinos during the just no payment. Posting 5.00 NZD away from Neteller so you can an online casino, come across 5.00 NZD on your own casino player membership. The brand new $5 deposit casino is actually an increasingly preferred selection for NZ gamblers.

Well-known time allocation variations

While you are a good nonresident alien the part of the tax year, you generally usually do not claim the brand new EIC. However, when you are partnered and choose in order to file a combined get back that have a great U.S. resident or resident spouse, since the chatted about lower than Nonresident Spouse Handled as the a citizen within the part step one, you’re eligible for the credit. It talk covers tax credits and repayments for citizen aliens, with a dialogue of one’s credits and you may repayments for nonresident aliens. An excellent nonresident alien essentially never document since the married filing as one. Yet not, a nonresident alien who is partnered to a great You.S. resident otherwise resident can pick getting managed while the a citizen and you will file a combined return for the Function 1040 or 1040-SR. If you don’t make the choice to file jointly, file Mode 1040-NR and use the newest Income tax Desk column or the Tax Calculation Worksheet for partnered people processing separately.

PNC Bank — to $eight hundred

The newest underpayment out of projected taxation punishment will maybe not apply at the newest the quantity the brand new underpayment away from a payment is made otherwise improved by people supply away from legislation which is chaptered throughout the and you can operative to have the brand new nonexempt seasons of your own underpayment. To demand an excellent waiver of the underpayment of estimated tax penalty, score form FTB 5805, Underpayment out of Estimated Tax from the People and you will Fiduciaries. In case your estate or faith comes with interest to the these penalties on the payment, select and you will enter these types of number regarding the greatest margin of Function 541, Top 2. Do not include the focus or penalty regarding the taxation due on line 37 otherwise reduce the overpaid tax online 38. The fresh personal bankruptcy estate that is created when just one borrower data a great petition lower than either a bankruptcy proceeding otherwise 11 of Label eleven of your You.S.

- Which can be applied on condition that you’ll have registered a joint go back with your spouse to your 12 months your lady died.

- You could claim some of the exact same loans you to resident aliens can also be allege.

- We offer casino and you can sports betting also provides out of third-party casinos.

- To help you allege a credit to own income taxes paid or accrued so you can a foreign country, you are going to essentially document Form 1116 with your Form 1040 or 1040-SR.

- For many who found a retirement shipping regarding the All of us, the new commission is generally susceptible to the fresh 29% (otherwise lower pact) speed from withholding.

To simply help participants figure out what work greatest at the a good minimal deposit casino $5, we’ve got discussed some quick info to assist you raise your odds of effective and possess a memorable gambling establishment experience. When you are most of these will most likely not apply to your, it’s likely that many of them have a tendency to. Cashing away an advantage at the a great $5 minimum deposit gambling establishment is as simple as it’s during the all other casinos. Gambling enterprises normally have an appartment directory of conditions and terms out of the brand new deposits.

Nonetheless it could take you a couple seeks manageable to help you cash-out a respectable amount. For this reason, it usually is a proceed to read the conditions and you may criteria, particularly if you is a new comer to the web gaming world. Sign up BiggerPockets and also have use of a house using tips, industry position, and you can exclusive current email address blogs.

Bank account

Generally the amount of the deposit ought not to affect the type of games you could otherwise never gamble. In the event you enjoy bingo, you might get % free bingo zero-place expected also offers as the really. Very, what is there to state about the video game inside 7Sultans gambling business view? Extremely, as the mentioned previously, the brand new game regarding the 7Sultans are typical from Microgaming, and that is only able to get noticed as the the new a very important thing. Whatsoever, the firm hit the big when you are an educated, and you may advantages away from throughout the world enjoy playing Microgaming titles for each and each day. He is calculated to help individuals and you will companies spend only easy for financial products, thanks to education and you will building top notch technical.

In the event the possibly match the newest filing conditions for nonresident aliens chatted about in the chapter 7, they have to file separate productivity while the nonresident aliens to possess 2024. If the Dick gets a resident alien once again inside the 2025, their choice is no more frozen. For taxation aim, a keen alien is actually someone who isn’t a U.S. resident. Aliens are classified as nonresident aliens and you may citizen aliens. It publication will allow you to influence their reputation and give you information you will need to document their You.S. tax return.